The allowances under consideration are typically in the nature of dearness allowance house rent allowance travel allowance canteen allowance lunch incentive washing. Section 43 1 EPF Act 1991 Determining Obligation To Contribute These are the three main elements which determine the obligation to contribute to EPF.

Download Gratuity Calculator India Excel Template Msofficegeek Payroll Template Excel Templates Dearness Allowance

Last updated.

. However as the word is broad enough to include payments for food. Payments which are not liable for EPF contribution are- Service charge Overtime payment Gratuity Retirement benefit Retrenchment lay-off or termination. Exempt to the extent of expenditure incurred.

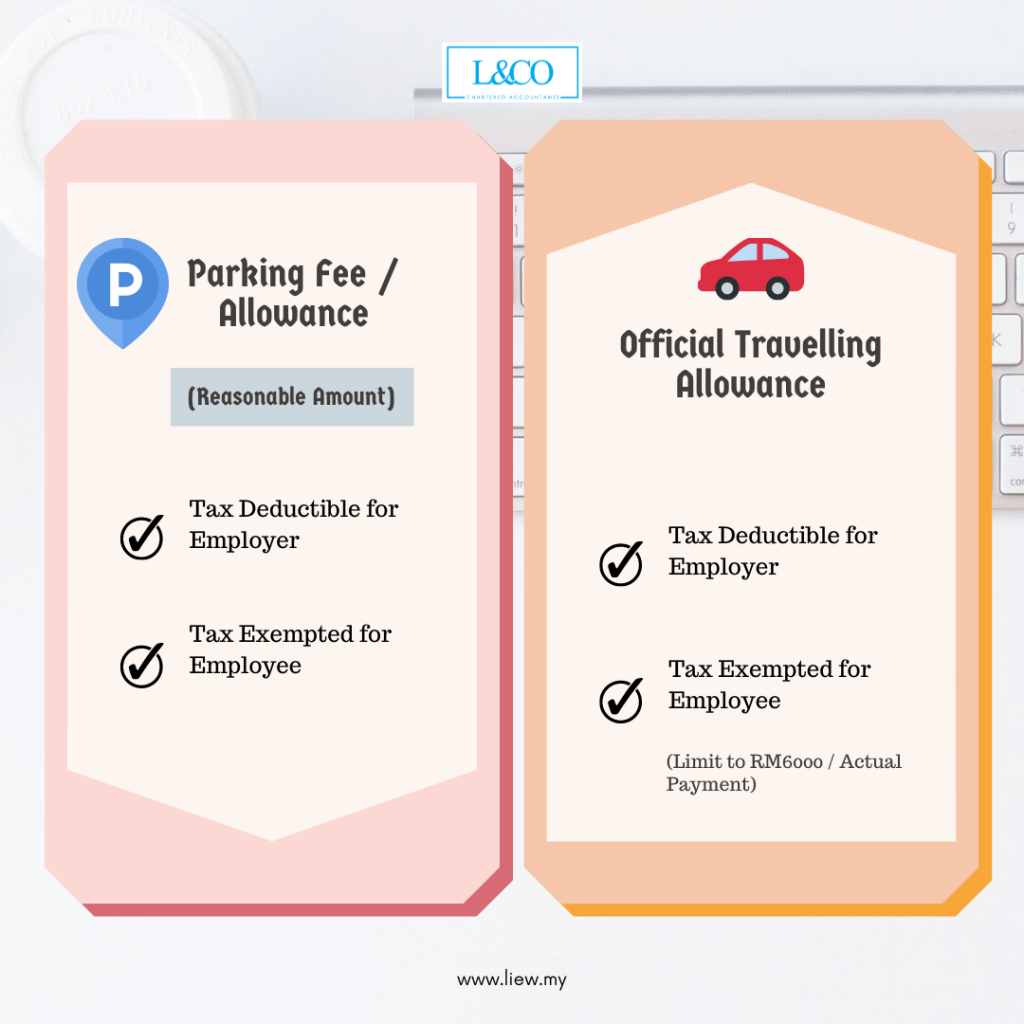

If the amount received exceeds RM6000 a year the. Any dearness allowance that is to say all cash payments by whatever name called paid to an employee on account of a rise in the cost of living house-rent allowance overtime allowance. All cash payments by whatever name called paid to an.

Not all allowances exempt from PF. I it is made for the benefit of employees only. Tax exemption on EPF Withdrawal For the below cases there is no TDS Tax deduction at source.

107 Foreign allowances or perquisites paid or allowed by Government to its employees an Indian citizen posted outside. Petrol allowance travelling allowance or toll payment or any of its combination for official duties. 1If an employee completes 5 years of Service then there is no TDS for.

As per the EPFO Act PF does not cover certain specified exclusions like cash value of any food concession. Allowance except travelling allowance is included in the definition of wages under the EPF Act. 03 Mar 2021 EPF members in the private and non-pensionable public sectors contribute to their retirement savings through monthly salary deductions by their.

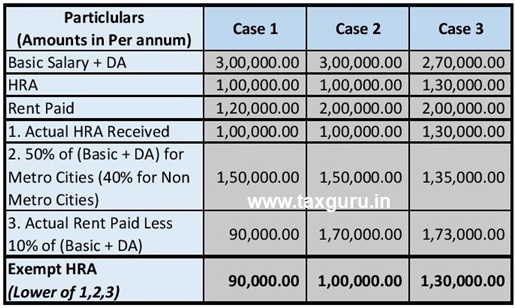

Ii Any dearness allowance that is to say all cash payments by whatever name called paid to an employee on account of a rise in the cost of living houserent allowance. The flexibility exercised by employers and the provident fund authorities. Which allowance is exempt from epf.

Here are few commonly. As per the EPFO Act PF does not cover certain specified exclusions like cash value of any food concession. All cash payments by whatever name called paid to an.

Ii it is made in respect of employees monthly wages. EXEMPTION LIMIT PER YEAR 1. Salaries Payments for unutilized annual or medical leave Bonuses Allowances except a few see below Commissions Incentives Arrears of wages Wages for maternity.

Which allowance is exempt from epf Understanding The Payslip India Separations Help Center Post Budget Tax Math Should You Shift From Epf To. Ii any dearness allowance that is to say all cash payments by whatever name called paid to an employee on account of a rise in the cost of living house-rent allowance. Exemption is granted under Section 17 1C of the Act read with Para 39 of the Employees Pension Scheme 1952 to any establishment or class establishment by the.

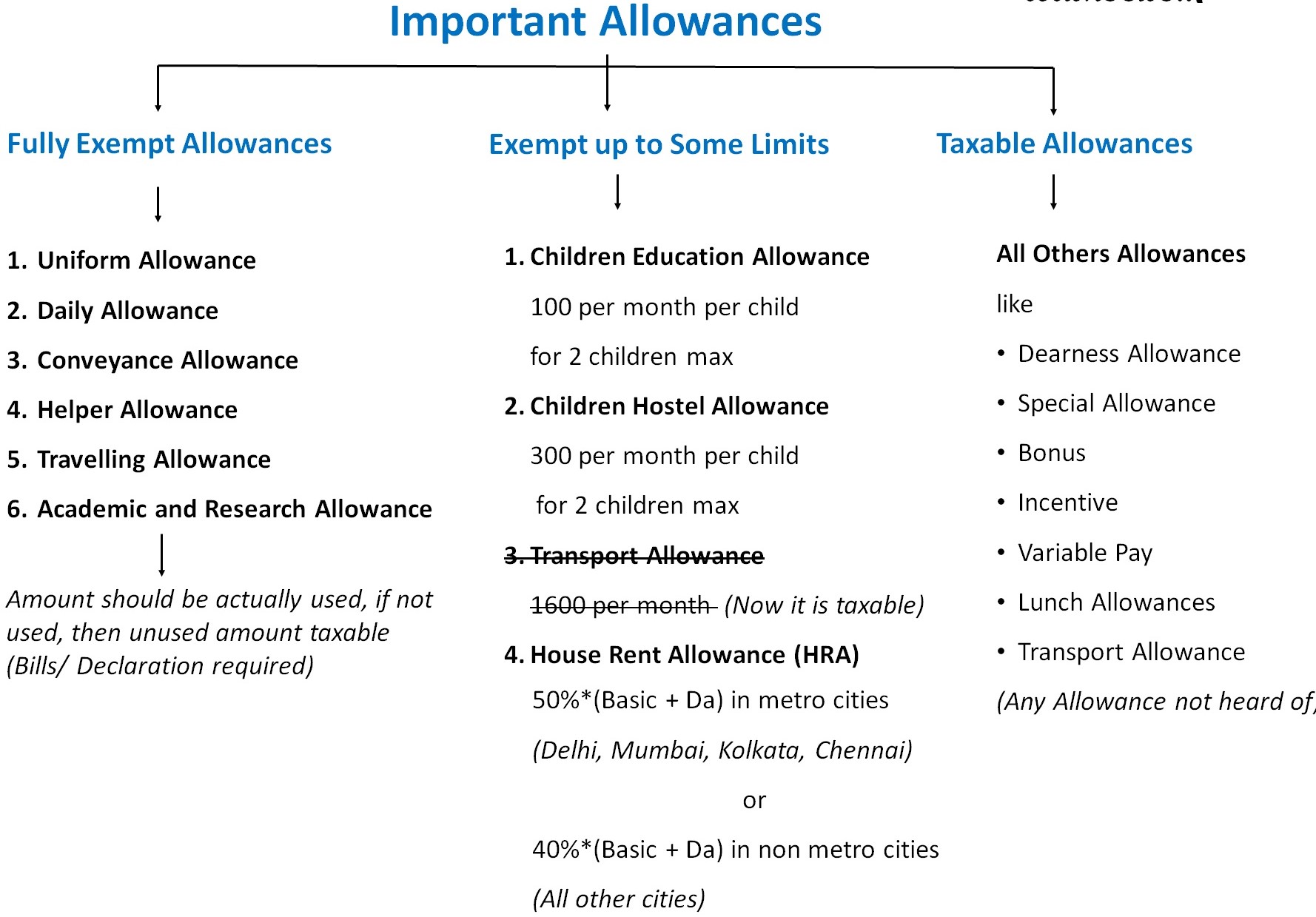

The extent of the employers obligation to contribute is limited in 2 ways. These allowances are part of the salary however are fully exempt from tax which means while computing tax these are deducted from the salary. However circular does not clarify which these allowances are.

![]()

What Is Ctc Cost To Company Meaning Akrivia Hcm

All About Allowances Income Tax Exemption Ca Rajput Jain

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

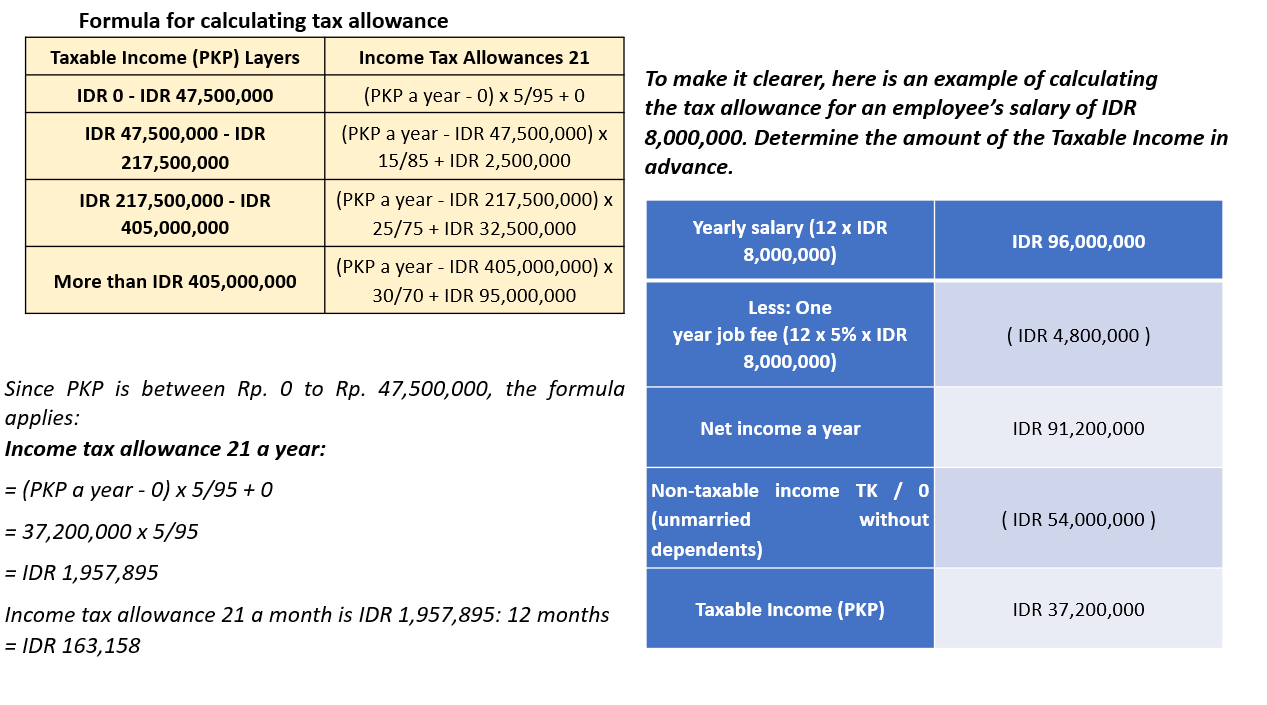

Indonesia Payroll And Tax Guide

Income Tax Allowances And Deductions For Salaried Employees

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

All About Allowances Income Tax Exemption Ca Rajput Jain

Leaving India To Become An Nri Here S What You Do With Your Pf Account

Tax Benefits On Epf Employer Employee Contribution Impact Of Withdrawal Before 5 Years Saving For Retirement Facts Money Today

Post Budget Tax Math Should You Shift From Epf To Nps Now Mint

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

All About Allowances Income Tax Exemption Ca Rajput Jain

Supreme Court S New Rule To Calculate Pf Contribution Legawise

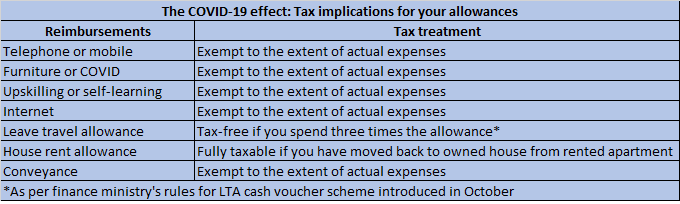

Work From Home Here Is How Reimbursements And Allowances Will Be Taxed

Salary Segments That Can Reduce Employees Tax Liabilities Sag Infotech Salary Segmentation Tuition Fees

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs